|

|

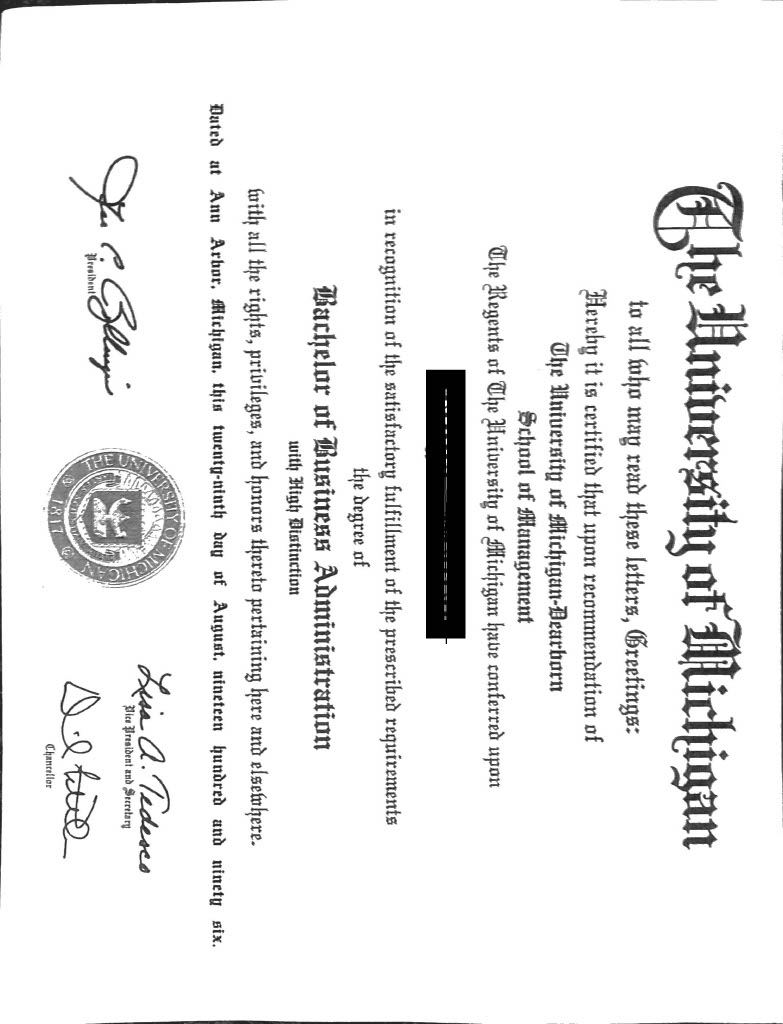

Case Studies Check Fund Manager's team of experienced investigators digs deep to uncover information that helps our clients evaluate manager character and credentials. Here are some real examples of recent investigations where our findings helped steer our clients away from high-risk investments. Investigators utilize unique skills and access to fill gaps missed by othersWhile many of our competitors only use automated software "intelligence" to access records, our investigators go far beyond these initial searches to scrutinize many sources that cannot be searched by software robots. In one recent case, Check Fund Manager's investigator flagged current felony drug charges on a subject, noting that the records were only available in very specifc local jurisdictions that the AI databases are unable to access. As one of the person's criminal cases was ongoing, our researcher was able to provide real-time updates to our client as the charges were being prosecuted and plea-bargained. This scenario is not unique. Just a short time after this research concluded, our investigation of a different subject revealed ten criminal cases from five different jurisdictions, with four out of five being missed by the record databases upon which our competitors rely. False university degree and transcript surface twiceTwo years ago, Check Fund Manager performed a routine university degree verification on a prospective investment manager for our client. Initial sources did not corroborate the person's stated education credentials, so our researcher spoke directly with the university registrar. Despite the subject's insistence that the degree was authentic, the registrar also could not verify either enrollment or graduation. The subject even submitted a photocopy of the diploma, which our researcher determined had been falsified.

Very recently, the same person was again under consideration for an investment. This time, the subject of our investigation provided an embossed university transcript that detailed course records and the degree obtained. Our researcher contacted the university registrar, who was again unable to verify the credentials presented by the subject. We flagged several inconsistencies in the transcript, and going the extra mile, our investigator even discovered the online document forging service that produced the phony transcript. In fact, the exact list of classes on the subject's fraudulent university transcript was identical to the "sample" degree promoted by the online provider! False records reported by AI database softwareA client contacted us after their use of an AI-based investigation tool indicated that the manager they were investigating was convicted of felony theft and served time in a federal prison. They asked us to corroborate the findings given the severity of the case. Our research revealed that the crime was not committed by this prospective manager, but by a different individual who stole the innocent manager's identity (name and date of birth) which was then erroneously entered into the public records when the criminal was apprehended. By having our experienced investigator perform more in-depth research, we were able to protect our client's reputation with the manager by avoiding an awkward confrontation and false accusation. Freedom of Information Act inquiry revealed sanctions before the fund collapsedOne of our investigators made a FOIA inquiry to the Securities and Exchange Commission as part of comprehensive research into a fund. Based on the correspondence received we suspected that the firm was under investigation by the SEC.

It turned out that the company was negotiating with the SEC to settle a securities fraud case. As a result, our client chose not to make a multi-million dollar investment into this fund, which ultimately was shuttered as a condition of the SEC settlement. Investigator linked disparate records to tell a manager's whole storyAlthough a manager's name was misspelled in multiple court records, our investigation revealed numerous criminal and civil cases. He also misrepresented education credentials in his biography, and had a bankruptcy filing that was complicated by additional serious charges. Even though the records contained many errors, Check Fund Manager's investigator was able to piece together his significant litigation history by matching up case numbers and dates via multiple sources, and by reviewing extensive case details which referenced other cases that the manager tried to deny. We were also able to produce his mug shot, proving his complicity in all of those cases. Common name confounds Artificial Intelligence softwareA client contacted us out of frustration when their AI-based investigation tool linked bankrutpcy court records to their manager, who had a common name. Our research identied the correct personal identifying information associated with the manager, thus eliminating the false connection to the bankruptcy records. Russian Investment Manager accused of International Loan FraudA client asked us to conduct pre-investment diligence on a Russian national with ties to other European countries. Our research uncovered an open court case in the Netherlands where the lender claimed the Russian corporation failed to repay a $25 million loan because the individual had misappropriated the proceeds into personal accounts. Three international jurisdictions were involved in this case, including frozen assets in the Netherlands and business holdings in Russia. Investigations reveal criminal records that managers were trying to eraseThe following serious cases were discovered by our researchers, even though the individuals were attempting to seal the records.

Misspelled Court records missed by DIY (Do it Yourselfers)Here is a list of misspellings uncovered by just one of our investigators in U.S. court records over the course of a year. The database lookup techniques used by clients who run their own name only based queries would have missed all of these.

|

Learn More about Contact us

to obtain a temporary access code, which will enable you to query our database of thousands of past reports. You will also be able to read privileged information in regard to our WatchList and SEC FOIA Research programs,

along with more details regarding our reports and services. |