|

CHECK FUND MANAGER

|

|

|

SERVICE SPOTLIGHT ONGOING MONITORING

In this ever-changing financial climate, there is a need to ensure that the people you are entrusting with your capital continue to meet your standards. Check Fund Manager's Ongoing Due Diligence Monitoring service helps by "watching" your managers and funds. Proactive Tracking This subscription-based service can help you meet your fiduciary responsibility for risk assessment by monitoring key records regarding your funds and managers. A subscription includes: Monthly Research into these three data sources:

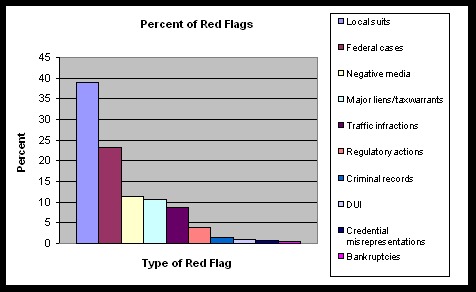

Instant Access to full investigative reports. Each time we conduct an investigation on one of your managers, you will be granted access to that report. Full Investigative Report on each of the managers or funds in your subscription at a minimum of once every twelve months. Thousands of Managers & FundsYou can choose to have us monitor any U.S.-based manager or company in our database, which contains more than 27,000 reports. Please note that for U.K.-based managers, we can provide the Instant Access and Annual Full Investigation Report components of our Ongoing Monitoring Service. Exception Alerts / Red FlagsCheck Fund Manager's online monitoring program presents color-coded entries (red, yellow, or green, based upon the severity of infractions) for each manager being monitored, along with details regarding the monthly updates and the investigative reports. Some of the more common exceptions we see as a result of Ongoing Monitoring include personal bankruptcy, SEC or RICO Act violations, other federal or local civil charges, new charges of fraud or substance abuse, and other recent criminal charges. Multiple infractions, even if seemingly inconsequential when evaluated individually, may also raise a red flag, depending on your risk tolerance level and that of your client. Contact us for additional information regarding our Ongoing Monitoring service and how it can help you mitigate risk.

|

LESSONS LEARNED Over the course of Check Fund Manager's thousands of investigations, we have developed insight regarding effective ways to conduct due diligence and protect your investment. Just because a manager passed your diligence protocols when you initially invested does not guarantee that the person's record will remain pristine over time. Example: In 2000, Galleon's Raj Rajaratnam and partner Krishen Sud made the list of highest earners on Wall Street, and Rajaratnam was once described as one of American’s “superstar” fund managers. A 2001 Check Fund Manager report detailed a dispute between these two former partners. Rajaratnam filed a $1 billion dollar lawsuit against Sud, claiming that when Sud left the company, he took investor lists and broker contacts with him. He also alleged that Sud hired away several employees from Galleon in order to start a new company. This was just the first red flag of what would prove to be many. Check Fund Manager investigated Galleon Group and Raj Rajaratnam on thirteen different occasions over a seven year period. Our reports were laden with lawsuits and past regulatory fines involving Rajaratnam and Galleon. In addition, we were able to warn our clients about the SEC investigation into the Galleon Group in July 2008, more than a year before it was made public by his arrest. Raj Rajaratnam was arrested in October 2009 and convicted in May 2011 of fourteen charges, including five counts of conspiracy and nine counts of securities fraud. In June 2013, an appellate court upheld Mr. Rajaratnam's conviction on insider trading charges. Lesson:Monitor your managers over the duration of your investment.  |

|

|

+1 860-666-9595 888-523-4483 |

|

|