Check Fund Manager, LLC

Spring 2013

|

|

SERVICE SPOTLIGHT INTERNATIONAL DUE DILIGENCE INVESTIGATIONS

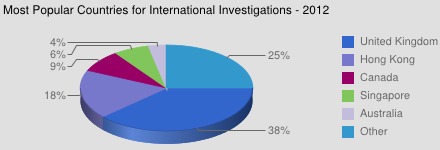

These days due diligence needs often extend beyond U.S. research with more and more managers and funds operating throughout the globe. At CFM, we are well equipped to help you meet these needs with extensive international due diligence capabilities. We have outlined some of our program's attributes below, along with providing a link to a detailed map of our investigative coverage. Preliminary Consultation When considering an international investigation it can be difficult to ascertain what information is available where, as different laws and customs significantly dictate information accessibility in each country. CFM will advise you on the investigative particulars of a specific country, including what information you can expect to successfully obtain, what is needed to acquire that information, and any additional items of note you should be aware of in each country. Further, we know that there are times your investigation needs may encompass multiple countries, which can be both expensive and confusing. In such cases, we will review the individual's biography and work history, and present to you a series of strategic options at different price points to help ensure you meet your coverage and economic goals. We know your international investigation needs can be unique, and we are often able to customize a multi-country report for you. On-site Investigators At CFM we believe in using on-site, credentialed investigators in each country for their proven ability to offer unique expertise on each country's laws, customs, and language. This local insight is invaluable in evaluating the investigative findings and helps us provide you with context around what records or reputation checks mean in each country. Additionally, our on-site investigators have cultivated a network of local sources that are often able to provide us with important information that is not yet public or that is not documented in public records. This information helps paint a broader and more complete picture of an individual and how he or she is perceived professionally and personally where he or she works and resides. Additional Benefits We frequently see international managers who have lived in the U.S. for a period of years, often while attending school. If the manager has a history in the U.S., we will include a basic U.S. investigation on the individual within your international report at no additional cost. Where applicable, this also includes verification of U.S.-based education. Searches of extensive international and U.S.-based watch lists are also conducted on all international investigations. Prior international investigations are also offered, when available, at a discount of between 25-50% Our international sales desk can be reached at +1 919-251-8503 or 888-523-4565.

|

LESSONS LEARNED Over the course of CFM's thousands of investigations, we have noticed some trends, from which we have taken certain lessons regarding how to conduct due diligence and protect your investment. When dealing with international managers who have crisscrossed the globe,

we have found that there is great value in media research. This can sometimes provide the only alert to problems overseas.

Florian Homm of Absolute Capital boasted an impressive resume, including graduating cum laude from Harvard University, with successful stints at Merrill Lynch and Fidelity. At the time of CFM's investigation, Homm was living in Switzerland with a known history in Spain and the U.S. Our client chose a U.S.-based investigation, but extensive media research revealed that Homm was facing regulatory troubles with the German Supervisory Authority of Financial Services, by which he was fined as early as 2004 for publishing false information. He also was fined in Frankfurt's district court for nonfeasance in 2005. Though the investigation was focused on U.S. research, this detrimental media information informed of problems in Germany which required further investigation. Homm resigned from Absolute Capital in late 2007 and disappeared. The SEC charged Homm and others with fraud and conspiracy regarding the manipulation of stock prices to inflate the value of his funds. In March of 2013, Homm was arrested in Italy after 5 years on the run. Now he is facing extradition to the U.S. on the charges related to allegedly defrauding investors in Absolute Capital of $200 million. Lesson: Follow up on negative global media. |

|

|

+1 860-666-9595 888-523-4483 |

|